Form 940 Schedule A 2025

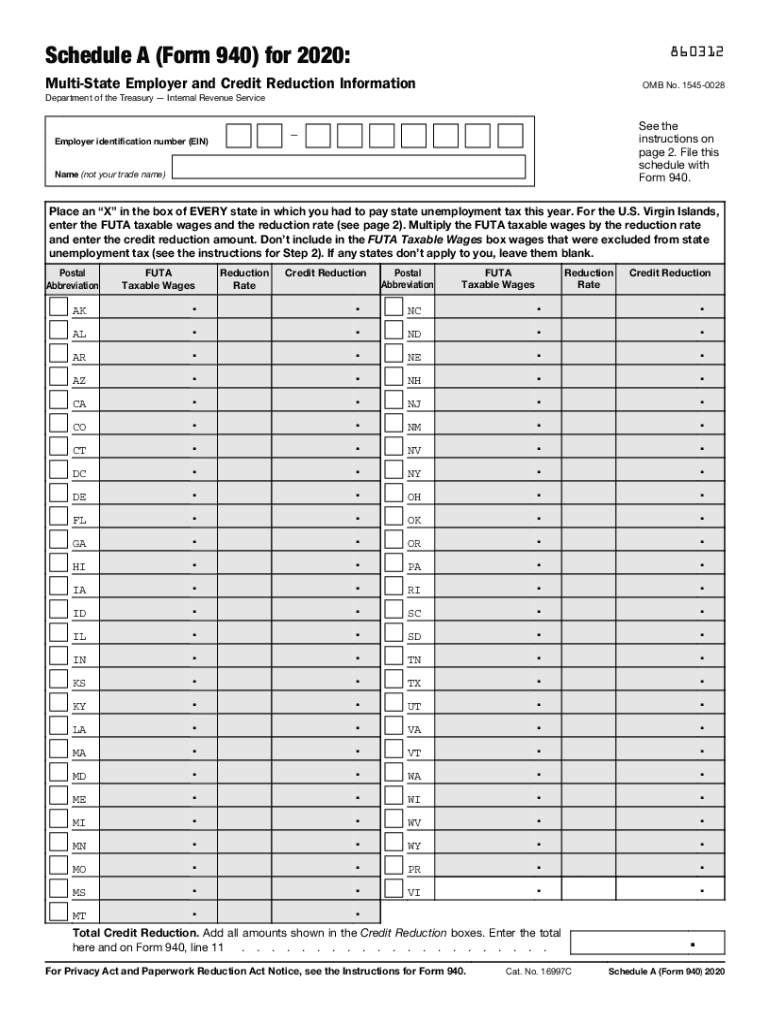

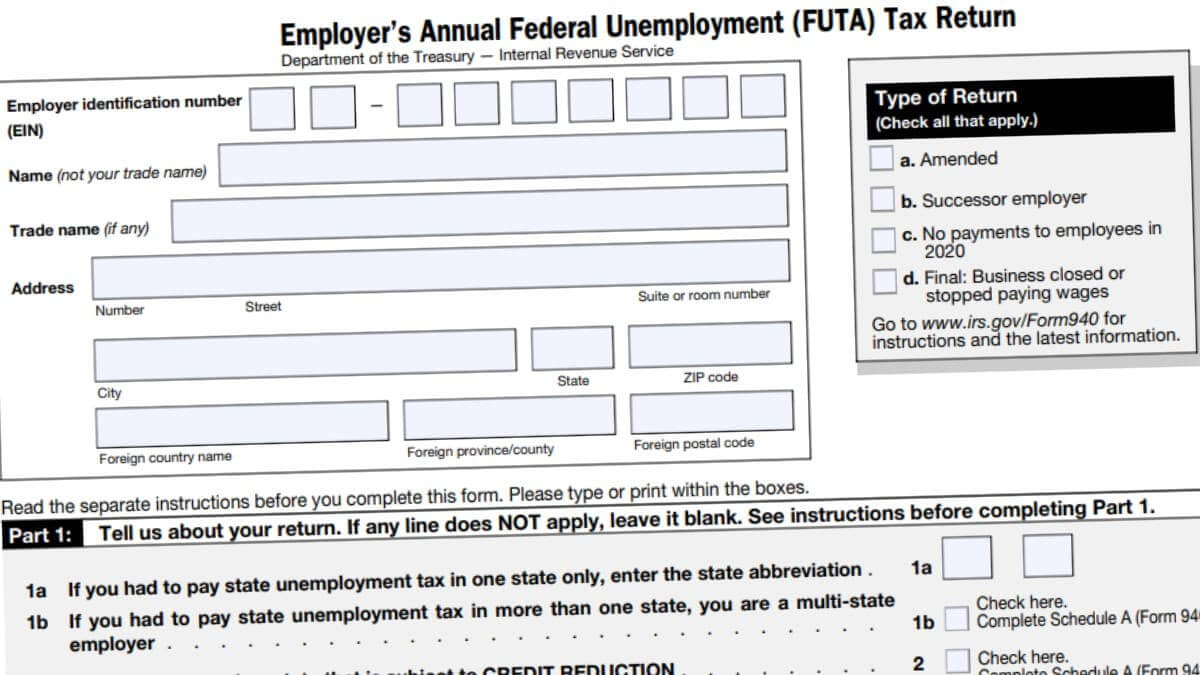

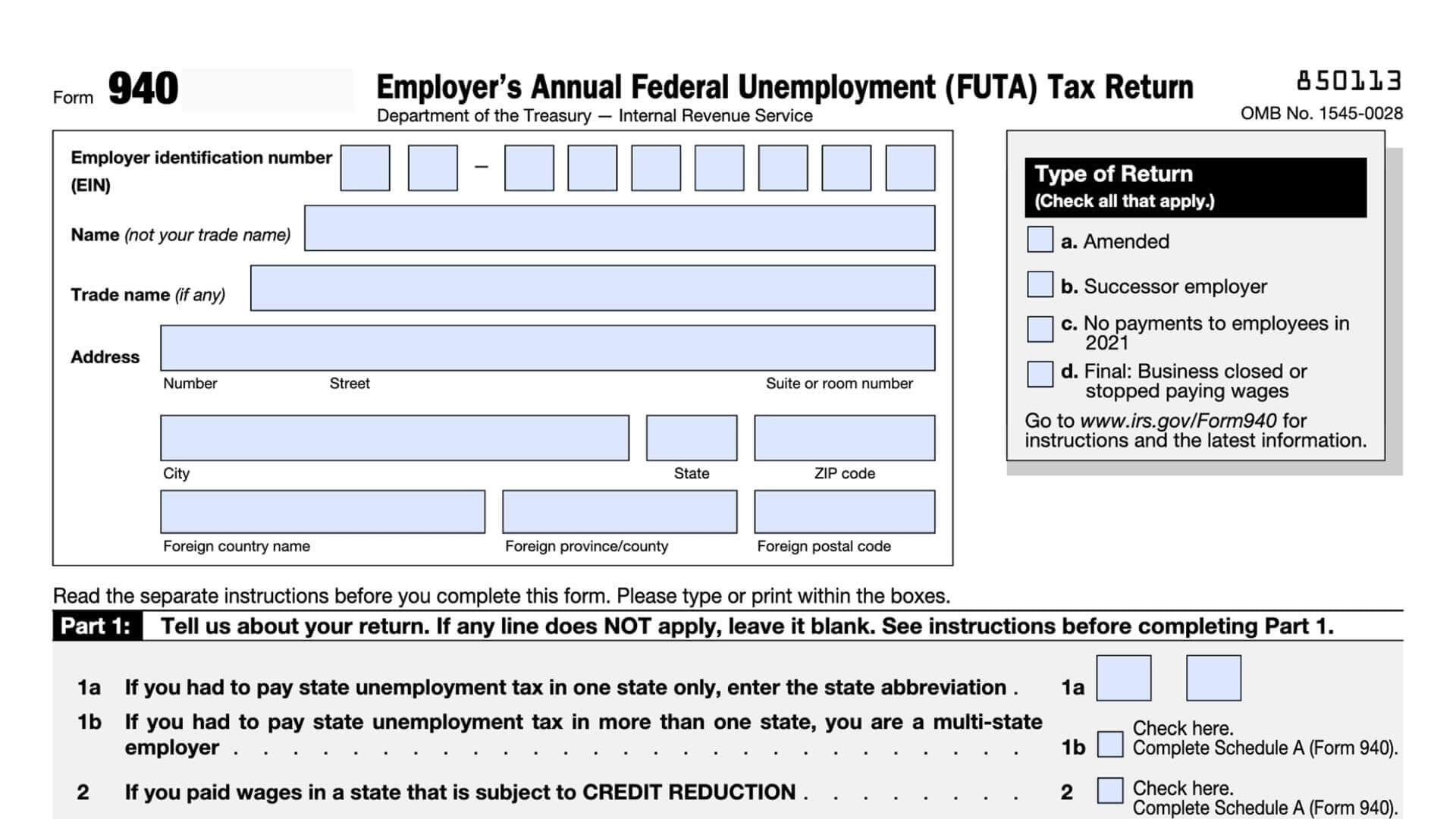

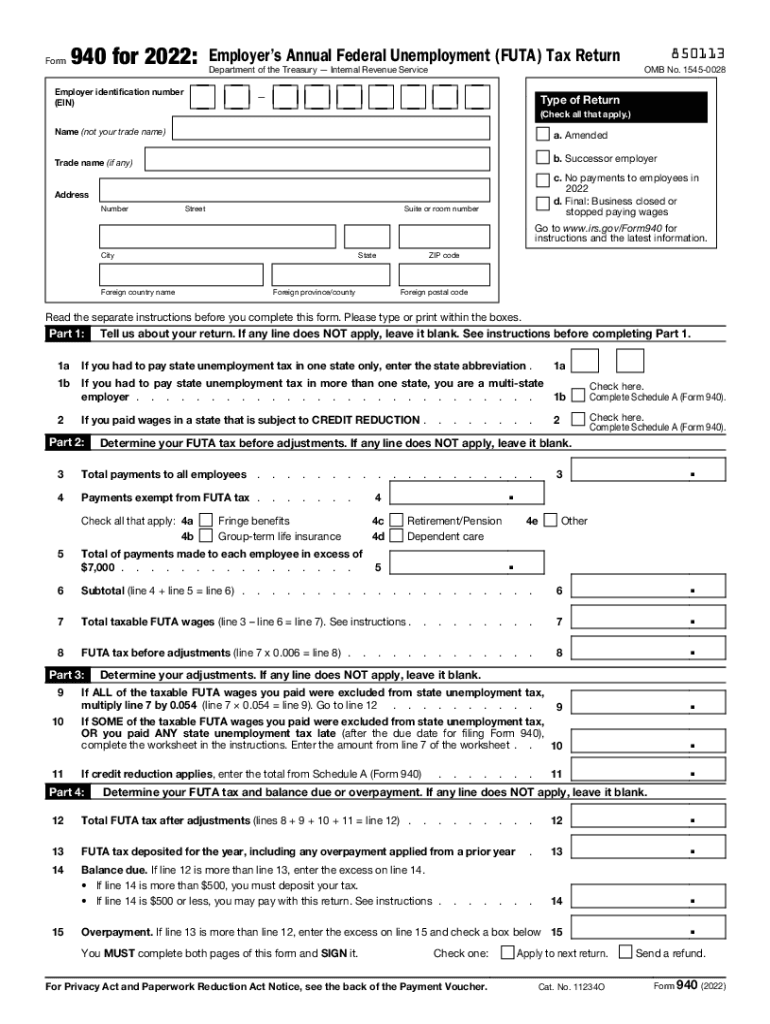

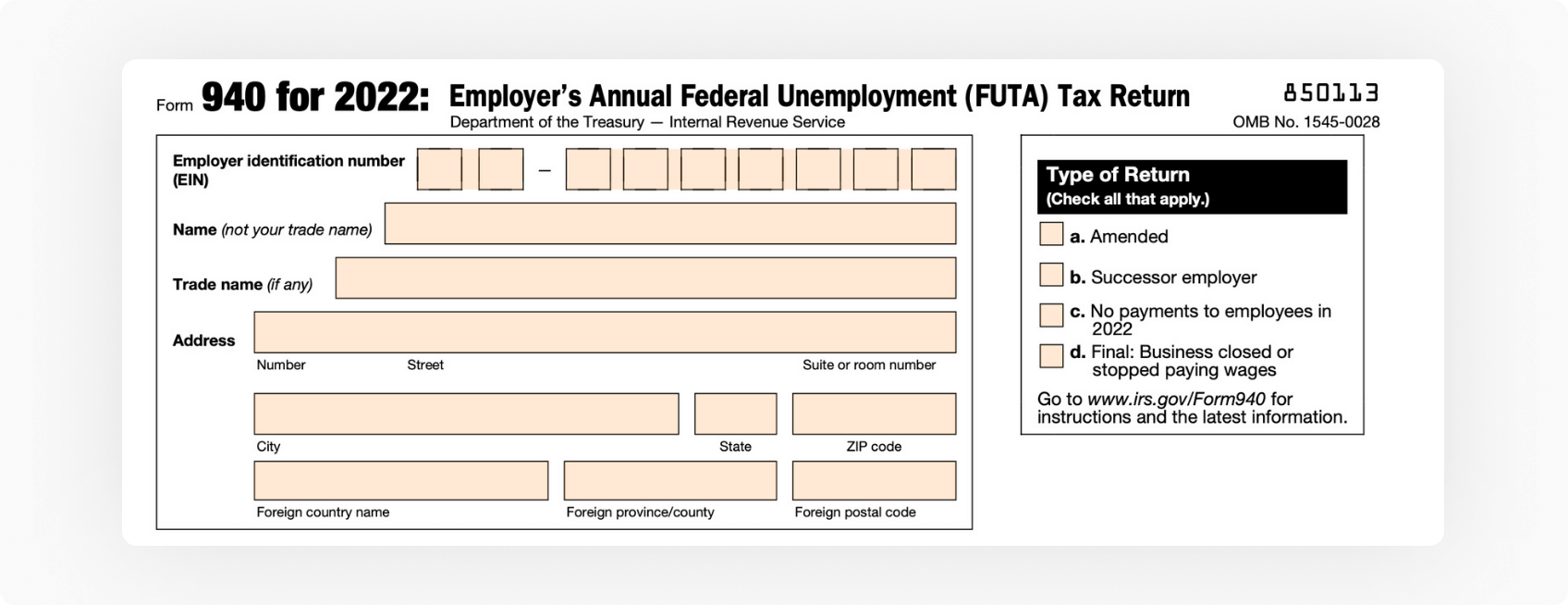

Form 940, Employer’s Annual Federal Unemployment Tax Return, is used to report and pay federal unemployment (FUTA) taxes. Schedule A of Form 940 is used to report the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico. It is important to accurately complete Schedule A to ensure that the correct amount of FUTA taxes is paid.

The name and address of each state, the District of Columbia, or Puerto Rico in which you paid wages

The total taxable wages paid to employees in each state, the District of Columbia, or Puerto Rico

The total FUTA tax liability for each state, the District of Columbia, or Puerto Rico

Once you have gathered the necessary information, you can complete Schedule A by following these steps:

Form 940 Schedule A is used to report the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico. It is important to accurately complete Schedule A to ensure that the correct amount of FUTA taxes is paid.

Schedule A must be filed with Form 940 by the last day of January following the close of the tax year. Failure to file Schedule A or to file it correctly can result in penalties.

Form 940 Schedule A is used to report the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico. It is important to accurately report state wages to ensure that the correct amount of FUTA taxes is paid.

It is important to carefully review the instructions for Schedule A to ensure that you are reporting state wages correctly. Failure to report state wages correctly can result in penalties.

Once you have reported the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico, you can calculate the FUTA tax liability for each jurisdiction. The FUTA tax rate is 6%.

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)

To calculate the FUTA tax liability, multiply the taxable wages by the FUTA tax rate. For example, if you paid $100,000 in taxable wages in California, your FUTA tax liability for California would be $6,000.

You must also calculate the FUTA tax credit. The FUTA tax credit is a dollar-for-dollar reduction in the FUTA tax liability. The FUTA tax credit is equal to 5.4% of the taxable wages paid to employees.

To calculate the FUTA tax credit, multiply the taxable wages by the FUTA tax credit rate. For example, if you paid $100,000 in taxable wages in California, your FUTA tax credit for California would be $5,400.

Your net FUTA tax liability is the FUTA tax liability minus the FUTA tax credit. In the example above, the net FUTA tax liability for California would be $600.

You must report the FUTA tax liability for each state, the District of Columbia, and Puerto Rico on Schedule A. You must also report the total FUTA tax liability on Form 940.

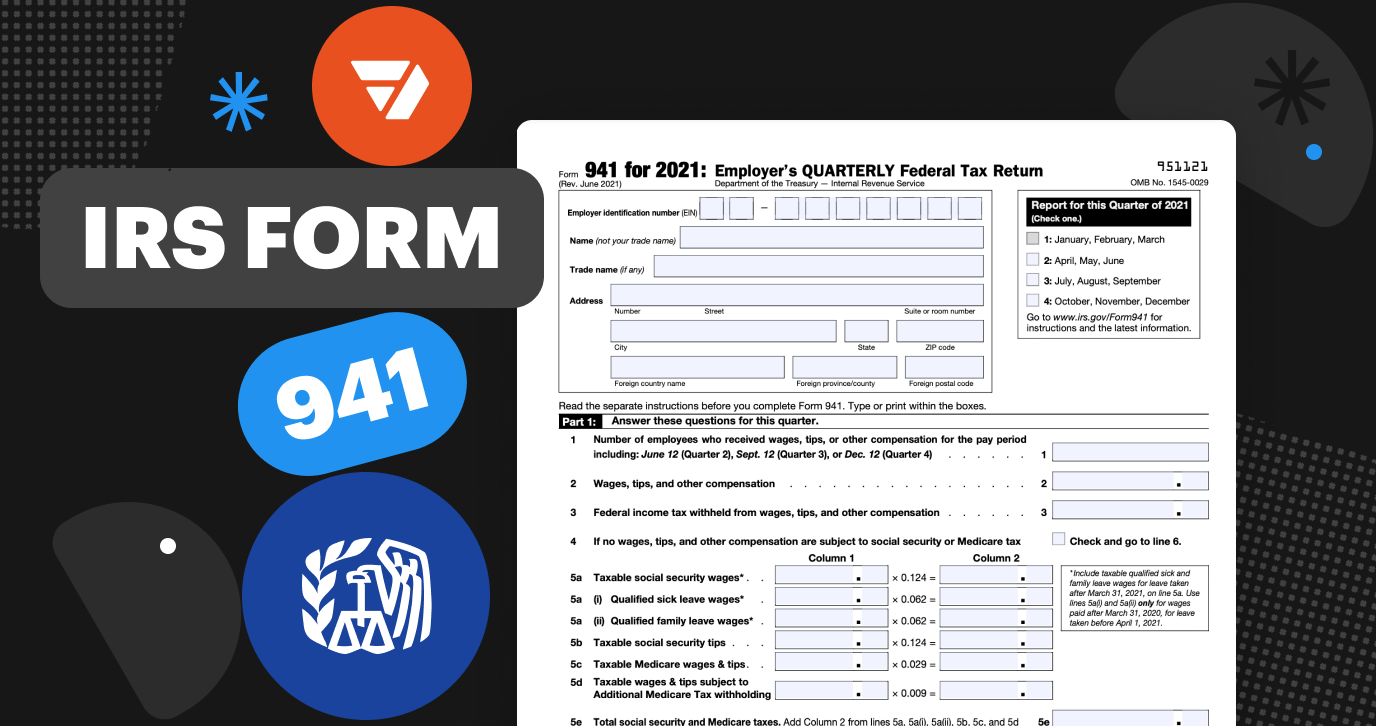

Schedule A is due with Form 940, Employer’s Annual Federal Unemployment Tax Return. Form 940 is due by the last day of January following the close of the tax year. For the 2025 tax year, Form 940 is due on January 31, 2025.

It is important to file Schedule A and Form 940 on time and to file them correctly to avoid penalties.

The IRS encourages employers to file Form 940 and Schedule A electronically. Electronic filing is the fastest and most accurate way to file your return. You can file Form 940 electronically through the IRS website or through a tax software provider.

To file Form 940 electronically through the IRS website, you will need to create an account on the IRS website. Once you have created an account, you can log in and click on the “File” tab. Then, select “Form 940” from the list of available forms. You will be able to enter your information directly into the IRS website or you can upload a completed Form 940.

If you choose to file Form 940 through a tax software provider, you will need to select a provider that is authorized by the IRS to file Form 940 electronically. Once you have selected a provider, you can enter your information into the provider’s software and the provider will file your return electronically with the IRS.

There are many benefits to filing Form 940 electronically. Electronic filing is faster than mailing your return, and it is more accurate because the IRS software will check for errors before submitting your return. Electronic filing also allows you to track the status of your return and to receive your refund more quickly.

Failure to file Schedule A or to file it correctly can result in penalties. The penalty for failure to file Schedule A is $50 per month, up to a maximum of $500. The penalty for filing Schedule A incorrectly is $100 per incorrect return, up to a maximum of $1,000.

By following these tips, you can avoid penalties and ensure that you are meeting your FUTA tax obligations.

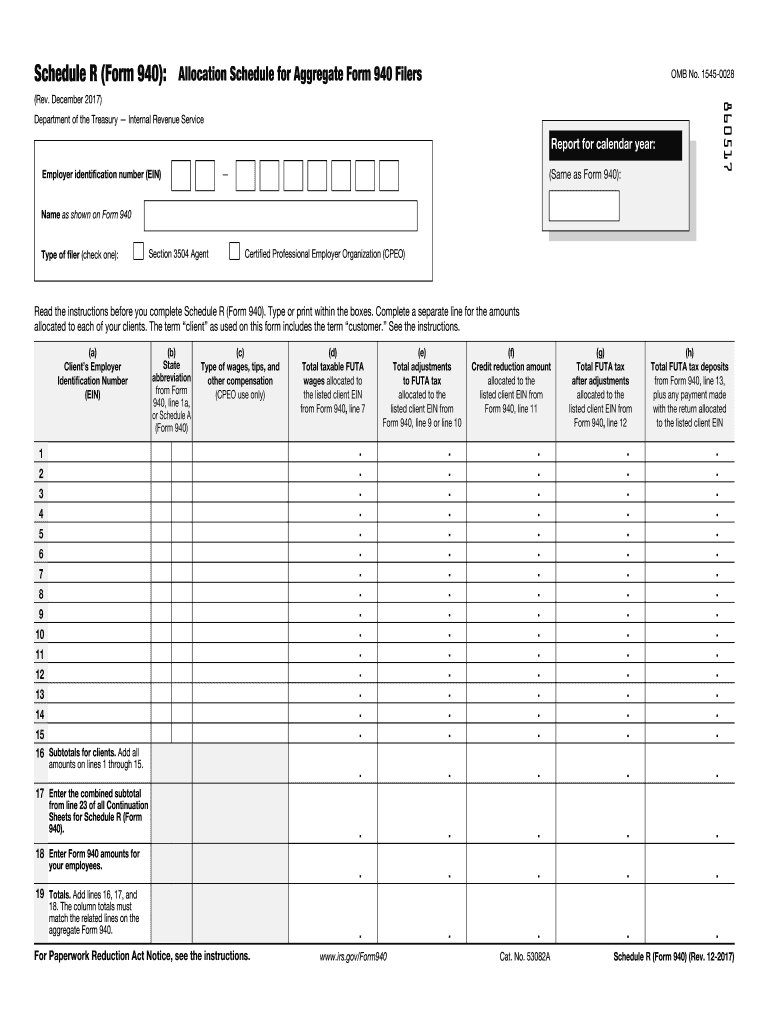

If you have employees who work in multiple states, you must file a separate Schedule A for each state. Each Schedule A must be attached to Form 940.

Once you have completed Schedule A for each state, you will need to attach the Schedules A to Form 940 and file the return with the IRS.

The taxable wage base is the maximum amount of wages that are subject to FUTA tax. For 2025, the taxable wage base is $8,000.

It is important to be aware of the taxable wage base when calculating your FUTA tax liability. If you are not sure whether all of your employees’ wages are subject to FUTA tax, you can consult with a tax professional.

The FUTA tax rate is 6%. This means that employers are required to pay 6% of the first $8,000 of wages paid to each employee.

It is important to be aware of the FUTA tax rate when calculating your FUTA tax liability. If you are not sure how to calculate your FUTA tax liability, you can consult with a tax professional.

Question 1: What is Form 940 Schedule A?

Answer: Form 940 Schedule A is used to report the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico. It is used to calculate the FUTA tax liability for each jurisdiction.

Question 2: Who must file Form 940 Schedule A?

Answer: All employers who are subject to FUTA tax must file Form 940 Schedule A. This includes employers who have paid wages to employees in multiple states.

Question 3: When is Form 940 Schedule A due?

Answer: Form 940 Schedule A is due with Form 940, which is due by the last day of January following the close of the tax year. For the 2025 tax year, Form 940 is due on January 31, 2025.

Question 4: How do I complete Form 940 Schedule A?

Answer: You can complete Form 940 Schedule A by following the instructions on the form. You will need to gather information about the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico.

Question 5: What is the FUTA tax rate?

Answer: The FUTA tax rate is 6%.

Question 6: What is the taxable wage base?

Answer: The taxable wage base is the maximum amount of wages that are subject to FUTA tax. For 2025, the taxable wage base is $8,000.

Question 7: What are the penalties for failing to file Form 940 Schedule A or for filing it incorrectly?

Answer: The penalty for failing to file Form 940 Schedule A is $50 per month, up to a maximum of $500. The penalty for filing Form 940 Schedule A incorrectly is $100 per incorrect return, up to a maximum of $1,000.

In addition to the information provided in the FAQ section, here are some tips for completing Form 940 Schedule A:

In addition to the information provided in the FAQ section, here are some tips for completing Form 940 Schedule A:

Tip 1: Gather your information before you start

Before you start completing Form 940 Schedule A, gather all of the information that you will need. This includes information about the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico.

Tip 2: Use the instructions

The instructions for Form 940 Schedule A are very helpful. Be sure to read the instructions carefully before you start completing the form.

Tip 3: File electronically

The IRS encourages employers to file Form 940 Schedule A electronically. Electronic filing is the fastest and most accurate way to file your return.

Tip 4: Keep a copy of your return

Once you have filed Form 940 Schedule A, be sure to keep a copy of your return for your records.

By following these tips, you can ensure that you are completing Form 940 Schedule A correctly and on time.

Form 940 Schedule A is an important form that must be filed by all employers who are subject to FUTA tax. By understanding the information and tips provided in this article, you can ensure that you are completing Form 940 Schedule A correctly and on time.

Form 940 Schedule A is an important form that must be filed by all employers who are subject to FUTA tax. The form is used to report the taxable wages paid to employees in each state, the District of Columbia, and Puerto Rico. It is important to complete Form 940 Schedule A correctly and on time to avoid penalties.

By understanding the information provided in this article, you can ensure that you are completing Form 940 Schedule A correctly and on time.